Investing isn’t reserved for the wealthy. With the right strategies, anyone can begin their investment journey, even with a small amount of money. In this guide, we’ll explore practical, actionable steps for starting your investment journey, no matter how limited your budget is. Investing early, even with modest amounts, allows you to harness the power of compounding, build wealth, and achieve financial independence over time.

1. Why Start Investing with Little Money?

A. The Power of Compound Interest

Compound interest enables your investment to grow exponentially over time as your returns generate their own returns. Starting small allows you to take advantage of this powerful phenomenon early.

B. Building Financial Discipline

Investing a small amount regularly fosters the habit of saving and disciplined money management, essential traits for long-term financial success.

C. Breaking the Barrier to Entry

Starting small helps you overcome the misconception that you need a large sum of money to invest. Thanks to modern tools and platforms, investing has never been more accessible.

2. How to Start Investing with Limited Funds

A. Set Clear Financial Goals

Before investing, identify your objectives:

- Short-term goals: Buying a gadget, building an emergency fund.

- Long-term goals: Retirement, buying a house, or achieving financial independence.Having clear goals helps you choose the right investment strategies and timelines.

B. Build an Emergency Fund

Before you start investing, ensure you have a safety net of 3-6 months’ worth of living expenses in a savings account. This fund will cover unexpected expenses without derailing your investments.

C. Pay Down High-Interest Debt

If you have high-interest debt, such as credit card balances, prioritize paying it off. The interest rates on such debt often exceed the returns you’re likely to earn from investments.

3. Investment Options for Small Budgets

A. Micro-Investing Platforms

Micro-investing apps like Acorns, Stash, and Robinhood allow you to start with as little as $5. These platforms often enable:

- Fractional Shares: Buy a portion of high-value stocks like Apple or Tesla.

- Round-Up Features: Automatically invest spare change from daily purchases.

B. Employer-Sponsored Retirement Accounts

If your employer offers a 401(k) or similar plan, start contributing even if it’s a small percentage of your paycheck. Many employers offer matching contributions, which is essentially free money.

C. Exchange-Traded Funds (ETFs)

ETFs are low-cost, diversified investment options that pool funds to buy a collection of stocks or bonds. Many ETFs have low expense ratios and require minimal initial investments.

D. High-Yield Savings Accounts

While not technically an investment, a high-yield savings account is a great place to park money while you save for future investments.

E. Robo-Advisors

Robo-advisors like Betterment and Wealthfront use algorithms to manage and grow your investments based on your financial goals and risk tolerance. These platforms often have low minimum requirements and fees.

F. Dividend Reinvestment Plans (DRIPs)

DRIPs allow you to reinvest dividends earned from stocks directly into additional shares, growing your investment without additional costs.

4. Strategies for Success When Investing Small Amounts

A. Start with What You Have

Don’t wait until you have a large sum to invest. Begin with as little as $5 or $10—it’s the habit that matters.

B. Automate Your Investments

Set up automatic transfers to your investment accounts. Automation ensures consistency and reduces the temptation to spend the money elsewhere.

C. Diversify Your Portfolio

Diversification spreads your money across various investments to minimize risk. Options include:

- Stocks

- Bonds

- ETFs

- Real estate (via REITs)

D. Reinvest Earnings

Reinvest dividends and interest earned to maximize growth through compounding.

E. Educate Yourself

Learn about the basics of investing, such as market trends, risk management, and asset allocation. Free resources include:

- Blogs (like Investing Simple)

- Podcasts

- YouTube channels

5. Mistakes to Avoid When Starting Small

A. Trying to Time the Market

Predicting market highs and lows is nearly impossible. Instead, focus on consistent, long-term investing.

B. Ignoring Fees

High fees can eat into your returns, especially when investing small amounts. Look for low-cost platforms and funds.

C. Overlooking Risk Tolerance

Choose investments that match your comfort level with risk. Avoid putting money into high-risk ventures if it’s your first experience.

D. Chasing Trends

Avoid investing based solely on hype. Research thoroughly and ensure your investments align with your goals.

6. The Long-Term Benefits of Starting Small

A. Developing Good Financial Habits

Starting small builds the habit of investing regularly, setting the stage for long-term financial growth.

B. Leveraging Time

Even small investments grow significantly over time. The earlier you start, the more time your money has to compound.

C. Confidence Building

Starting small allows you to learn and gain confidence in managing your investments without significant financial risk.

7. Tools and Resources to Help You Start

A. Investment Calculators

Online tools help you understand how your investments can grow over time based on contributions and expected returns.

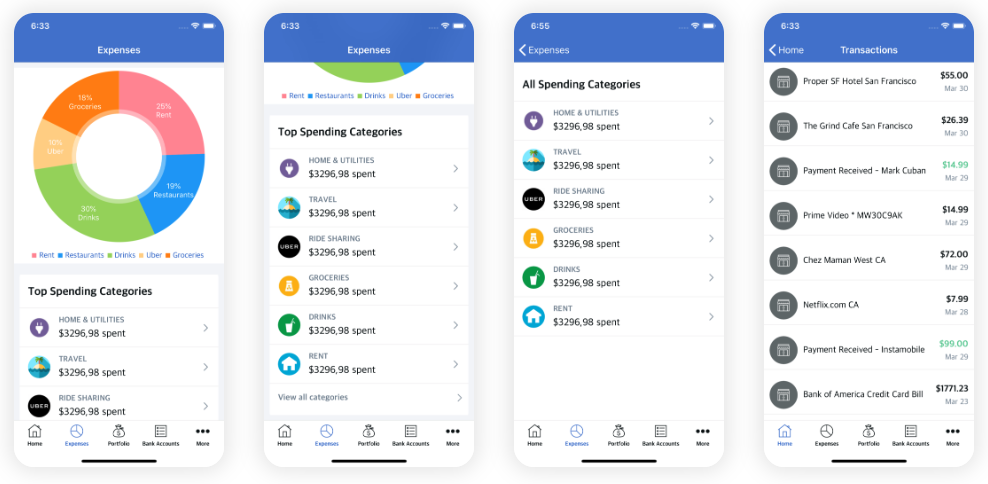

B. Budgeting Apps

Apps like Mint or YNAB (You Need a Budget) help you allocate money for investments.

C. Financial Communities

Join forums or social media groups like Reddit’s r/personalfinance to learn from others and stay motivated.

8. Real-Life Examples of Starting Small

A. Sarah’s Story

Sarah, a recent college graduate, started investing $10 a week using a micro-investing app. Over three years, her portfolio grew to $2,000 through consistent contributions and market growth.

B. Mike’s 401(k) Journey

Mike began contributing 3% of his paycheck to his employer’s 401(k). With employer matching and market returns, his retirement account grew significantly over a decade.

Conclusion

Starting your investment journey with little money is not only possible but also highly rewarding. The key is to start now, no matter how small your contributions. By leveraging tools, adopting smart strategies, and maintaining consistency, you can build a solid financial foundation for the future. Remember, it’s not about how much you start with but how committed you are to the process.

Take that first step today—your future self will thank you!

Post a Comment